Tax revenue from retail marijuana sales in Colorado, Oregon and Washington is exceeding initial estimates, according to a report published by the Drug Policy Alliance.

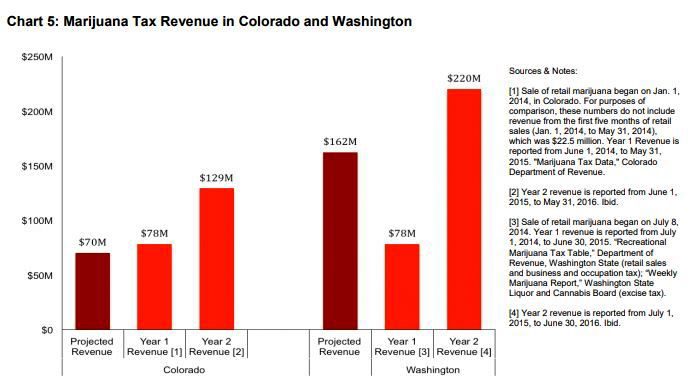

Colorado retail tax revenue was $129 million for the 12-month period ending May 31, 2016 which exceeded the initial estimate of $70 million per year.

Washington retail tax revenue was $220 million for the 12-month period ending June 30, 2016, where regulators had initially predicted sales tax would be $162 million.

In Oregon, marijuana-related tax revenues are about $4 million per month which is about twice what regulators initially predicted.

See the full DPA report – What We Know About Marijuana Legalization in Colorado, Washington, Alaska, Oregon and Washington, D.C.